Renewing your car insurance is an essential part of responsible vehicle ownership. It ensures your vehicle remains protected and keeps you in compliance with legal requirements. Keep reading to find out how to renew your car insurance effortlessly.

Renewing your car insurance is an essential part of responsible vehicle ownership. It ensures your vehicle remains protected and keeps you in compliance with legal requirements. Keep reading to find out how to renew your car insurance effortlessly.

Write a comment ...

Understanding the difference between an insurance broker and an insurance agent is key when shopping for coverage. While both help you find policies, brokers work independently to offer multiple options, whereas agents typically represent one insurer. Knowing who you're working with can impact your choices and savings. Continue reading to dive deeper into how each role serves your insurance needs. Read more in our comprehensive guide! Visit Us: https://www.abegtinsurance.com/difference-between-insurance-broker-and-agent/

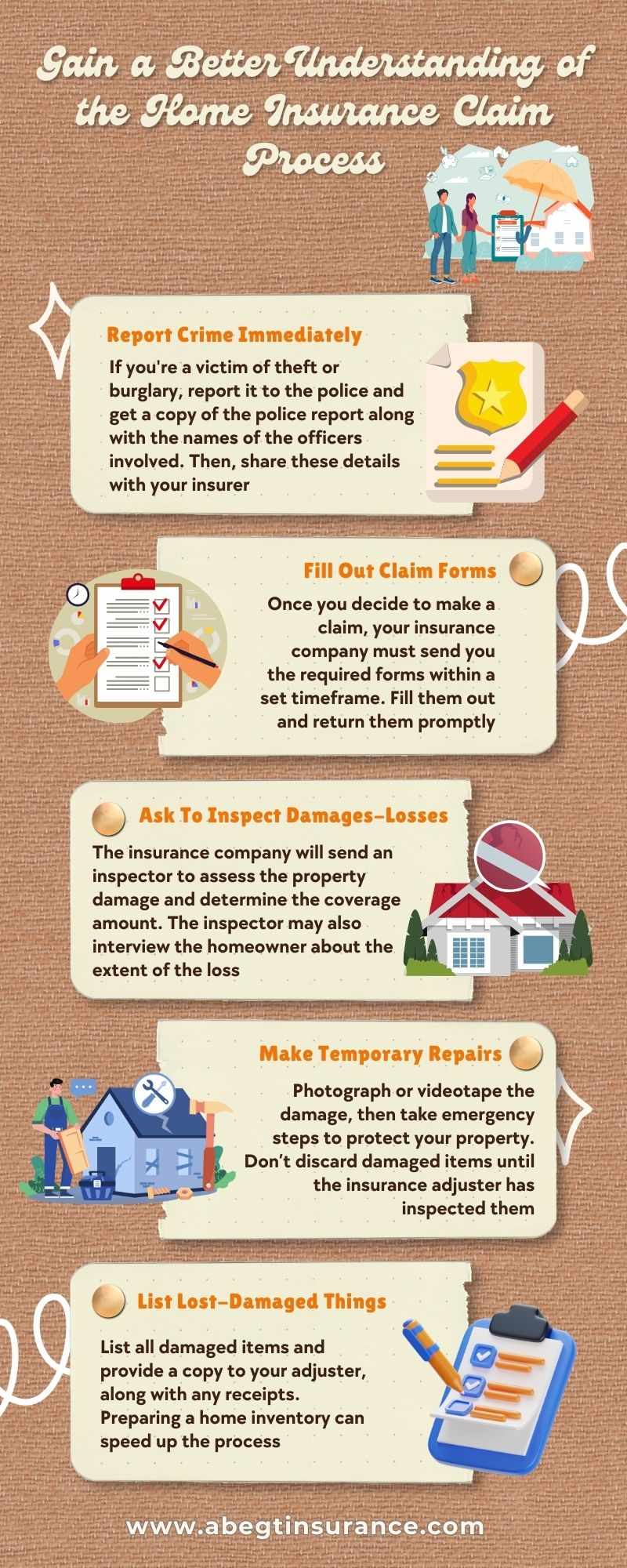

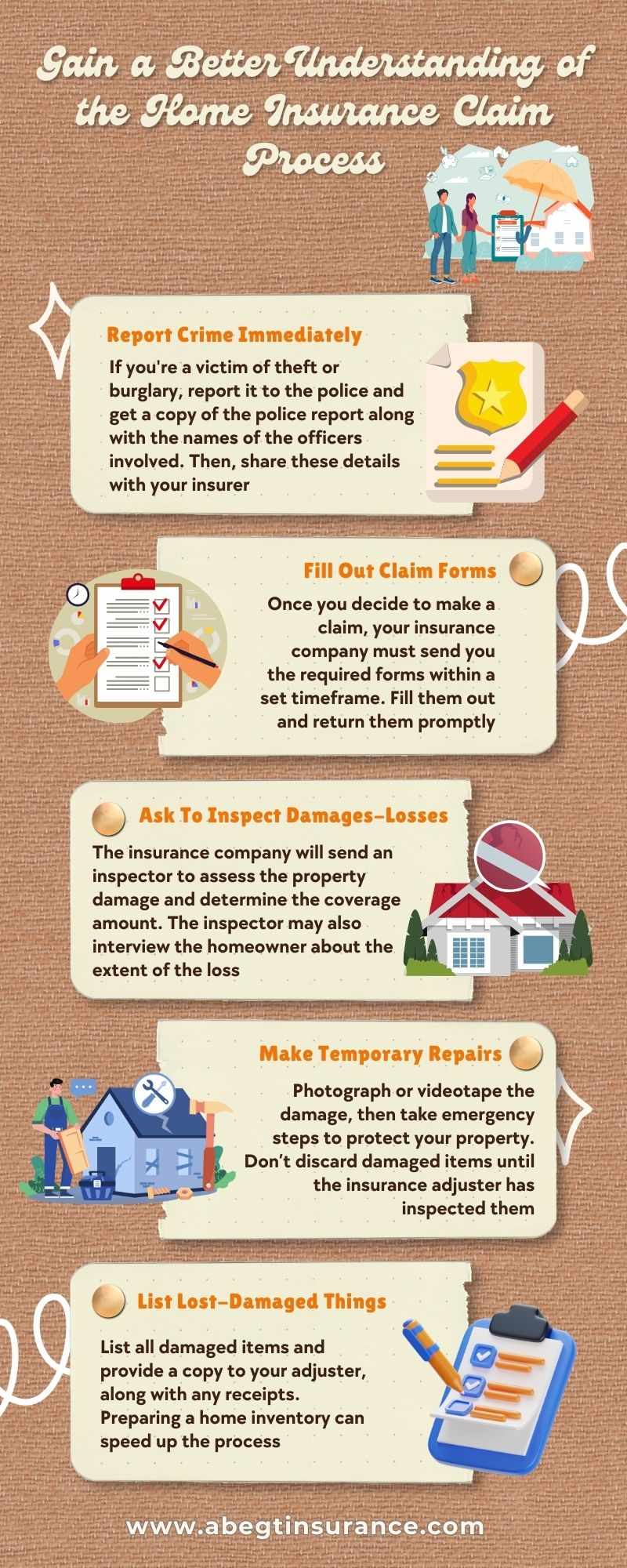

Home insurance is essential for safeguarding your property. If you ever need to file a claim, act quickly: report any crime to the police, contact your insurance agent, complete the necessary forms, and request a damage inspection. Continue reading to dive deeper into managing your home insurance. Read more in our comprehensive guide!

Getting the right condo insurance coverage, also known as HO-6 insurance, can be overwhelming as you consider what to include and what to exclude. Don't worry! This article will help you explore your coverage options and make an informed decision that suits your needs. Read on to learn more about condo insurance and how it keeps you protected.

Choosing auto insurance can be overwhelming, with numerous options to navigate. Without expert guidance, you might overspend or miss out on essential coverage. Abe GT Associates simplifies the process. Explore how to choose the best auto insurance: plans and coverage to find the right protection, simply and affordably.

Owning a home or condo comes with its share of risks—natural disasters, theft, and unexpected repairs can strike any time. But the type of property you own dictates the kind of insurance you need. Condo insurance typically covers your unit and personal belongings, while homeowners insurance is more comprehensive, covering the entire property, including the structure and land. Curious about which one is right for you? Dive deeper into condo insurance vs. homeowners insurance and discover the key differences. Keep reading to learn more and make sure your property has the protection it deserves! Visit here: https://www.abegtinsurance.com/condo-insurance-vs-homeowners-insurance-key-differences/

Condo association insurance coverage plays a vital role in protecting shared spaces within your community, such as hallways, elevators, and recreational facilities. It typically provides liability protection for accidents in these common areas and can cover damages to the building itself. Understanding the specifics of this coverage helps ensure that you and your fellow residents are adequately protected. For a deeper dive into what this insurance entails and how it benefits you, continue reading what does condo association insurance policy covers.

Owning a condo or home comes with its own set of risks, from theft to unexpected repairs. Condo insurance protects your unit and personal belongings, while homeowners insurance covers the entire property. Understanding these differences is key to making sure you're fully protected. Explore the key distinctions between condo insurance vs. homeowners insurance in this and find the right coverage for your property!

Ensuring your condo is fully covered is vital, as your association's policy often misses key areas of protection. Condo insurance addresses these gaps, covering your personal belongings and liability. At Abe GT & Associates, we focus on the unique needs of owners by providing expert condo insurance agents in Orland Park. Safeguard your investment—contact us today for a personalized quote!

When filing a home insurance claim, acting swiftly is crucial to ensure you’re properly protected. Start by reporting any crimes, such as theft or vandalism, to the police immediately. Then, contact your insurance agent to begin the claims process. Completing and submitting the necessary forms promptly is essential. Also, request an inspection of damages to assess the extent of your losses accurately. By understanding these steps, you can navigate the claims process more efficiently and safeguard your property effectively. Continue reading about the home insurance guide and get a better understanding.

Ensuring an employee is fit for duty is essential when filing a worker’s compensation claim. These exams verify that the worker can safely perform job duties post-injury, protecting both the employee and employer. It also aligns with legal standards, helping avoid penalties. For more insights on why is a fit-for-duty exam needed for a worker’s compensation claim and its significance check this out.

In today's unpredictable world, businesses need protection against financial losses caused by unexpected events such as natural disasters, theft, or liability claims. Commercial insurance offers this crucial safety net. At Abe GT & Associates, we understand your specific needs and are committed to helping you choose the best coverage for commercial insurance in Lansing. Contact us today to take advantage of your needs!

Home security systems have gained popularity in recent years as an effective way to protect our loved ones and valuable possessions. Installing a security system offers many benefits, including deterring intruders, alerting authorities in emergencies, and providing peace of mind. To learn more about the benefits of installing home security systems, read our informative blog.

Write a comment ...